Tax-Efficient Giving

Options That Fit Your Financial Goals

Donor Advised Funds

Make a gift through your Donor Advised Fund (DAF). A DAF is a philanthropic giving vehicle like a charitable savings account. It provides immediate tax benefits to you, and allows you to easily support the WhidbeyHealth Foundation and other charities of your choice.

Need to Establish a Donor Advised Fund?

Contact the Whidbey Community Foundation for more information on establishing a Donor Advised Fund or email: info@whidbeyfoundation.org

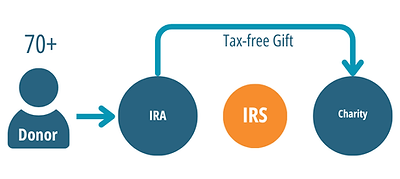

Qualified Charitable Distributions

If you are 70.5 years or older you can donate directly from an Individual Retirement Account (IRA) to WhidbeyHealth Foundation.

Qualified Charitable Distributions (QCD’s) or IRA tax free gifts are a great way to support our work & you. QCD’s count towards your Required Minimum Distribution and reduce taxable income.

How to Make an IRA Qualified Charitable Distribution

Contact your IRA Administrator and ask them to transfer funds to the WhidbeyHealth Foundation.

Help us thank you by having your IRA Administrator include your full name and mailing address on the gift.